The global fastener industry's growth now connects directly to emerging markets. Massive government projects and rapid industrialization create powerful demand. This surge is especially strong in the automotive and construction sectors across Asia, the Middle East, and Africa. Market research firms project significant expansion for the industry.

Research Firm | Market Size by 2030 (USD Billion) |

|---|---|

131.45 | |

146.3 |

These regions require high-quality, specialized fastening solutions. This need is fundamentally reshaping the global supply chain and driving new innovation.

Infrastructure and Construction: The Epicenter of Demand

The foundation of the fastener industry's growth lies in infrastructure and construction. Massive government spending and rapid city development in emerging markets fuel this surge. These large-scale projects require enormous quantities of reliable fastening components. This demand makes the construction sector the true epicenter of the 2025 fastener outlook.

Government-Led Megaprojects in India and the Middle East

Governments in India and the Middle East are launching ambitious megaprojects. These initiatives are rebuilding national infrastructure and creating unprecedented demand for fasteners.

In India, the government has committed over $1.4 trillion to infrastructure through 2025. These projects create a massive need for structural bolts, nuts, anchors, and other specialized fasteners. Key initiatives include:

PM Gati Shakti Master Plan: This national plan connects dozens of ministries on a digital platform. It coordinates all infrastructure planning for roads, railways, and ports.

Bharatmala Pariyojana: This is India's largest highway program. It aims to build over 34,800 km of new national highways to improve freight movement.

Industrial Corridors (NICDC): The government is developing 11 industrial corridors. These zones will establish India as a global manufacturing hub.

Dedicated Freight Corridors: Projects like the Western Dedicated Freight Corridor (WDFC) create freight-only rail lines. They boost cargo efficiency and reduce logistics costs.

In the Middle East, nations are diversifying their economies away from oil. Saudi Arabia is leading this transformation with visionary projects like NEOM, a futuristic smart city, and The Red Sea Project, a luxury tourism destination. These developments are driving a construction boom that requires a steady supply of high-performance fasteners.

The Impact of Rapid Urbanization in Asia and Africa

Cities across Asia and Africa are growing at an incredible rate. Millions of people are moving from rural areas to urban centers. This rapid urbanization creates a constant need for new construction.

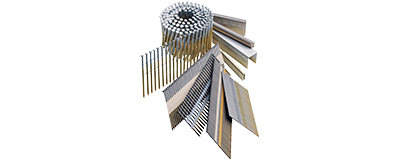

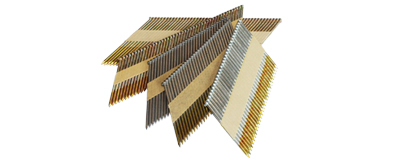

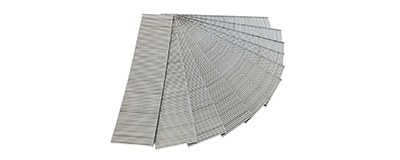

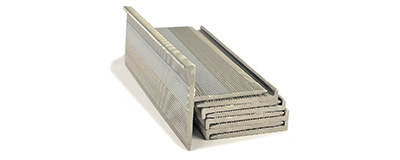

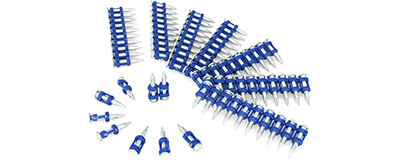

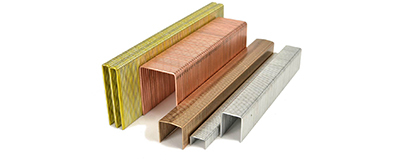

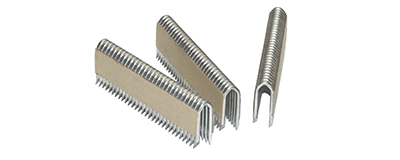

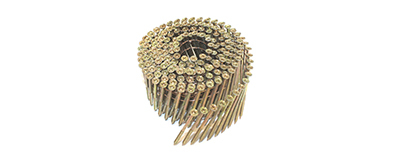

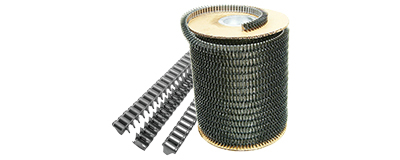

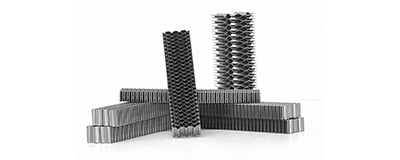

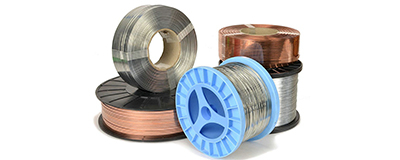

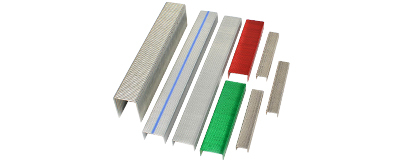

Every new apartment building, office tower, and shopping center requires millions of fasteners. Wood-frame construction for residential housing consumes vast amounts of industrial staples and industrial nails. Steel structures depend on heavy-duty bolts and anchors. This building boom extends to public works, including new roads, bridges, and utility networks that connect these expanding urban areas. The sheer volume of construction makes urbanization a powerful and consistent driver of fastener demand.

High-Demand Fasteners: Structural and Corrosion-Resistant

Infrastructure projects demand fasteners that guarantee safety, strength, and longevity. Structural fasteners must withstand immense physical stress, while corrosion-resistant coatings are essential for durability in harsh environments. Choosing the correct fastener is critical for the integrity of any structure.

Industry standards define the specifications for these critical components. The American Society for Testing and Materials (ASTM) provides the benchmark for quality and performance.

Specification | Description | Common Use |

|---|---|---|

The unified standard for high-strength structural bolts. It replaces older standards like A325 and A490. | Steel-to-steel connections in buildings, bridges, and heavy equipment. | |

ASTM F1554 | A specification for anchor bolts. These bolts secure structural supports to concrete foundations. | Anchoring steel columns, traffic signals, and heavy machinery. |

ASTM A563 | The standard for carbon and alloy steel nuts. It covers various grades for different strength levels. | Used with structural bolts to create secure bolted joints. |

Manufacturers must adhere to these standards to supply fasteners for major projects. The growth in emerging markets is pushing suppliers to increase production of these high-specification products, ensuring that new bridges, highways, and buildings are safe and built to last.

Automotive and Mobility: Powering the Revolution in Emerging Markets

The automotive sector is a primary engine for fastener demand. As vehicle production shifts to new global hubs, the need for a vast range of fastening components grows with it. This revolution in mobility, especially the move toward electric vehicles, is creating significant opportunities for fastener suppliers.

Manufacturing Hubs Fueling Automotive Fastener Needs

New automotive manufacturing hubs are appearing across the globe. These regions are building powerful ecosystems that demand a steady supply of fasteners for assembly lines.

Morocco has become Africa's largest car exporter. Its automotive sector accounted for nearly a quarter of its economic activity in 2023. The country plans to produce one million cars annually by 2025. Japanese automakers like Toyota and Honda also see India as a vital production base. Honda will use India to produce and export its 'Zero series' electric cars starting in 2027. Meanwhile, Chinese companies like BYD and Geely are investing heavily in assembly plants and dealer networks across Southeast Asia and Latin America. These developments show a clear trend: vehicle production is decentralizing, creating localized demand for everything from structural bolts to interior hog rings and staples.

The Electric Vehicle (EV) Shift and Component Demand

The global shift to electric vehicles is creating a surge in demand for specialized fasteners. EVs are more complex to assemble than their internal combustion engine (ICE) counterparts. This complexity translates directly to a higher fastener count.

An EV requires significantly more fasteners than a traditional car. The battery pack alone can use hundreds of specialized bolts and screws to ensure safety and structural integrity.

Vehicle Type | Fastener Requirement |

|---|---|

Electric Vehicles | 20-30% more than ICE vehicles |

Battery Pack Assembly (EVs) | 200-400 fasteners per vehicle |

Average Modern Vehicle | ~3,000 fasteners total |

This increased demand is not just about quantity; it is also about quality and specialization. EV manufacturing requires advanced fastening solutions to meet unique challenges.

Lightweight Materials: Fasteners made from aluminum and advanced polymers help reduce vehicle weight and improve battery range.

High-Strength Fasteners: Special alloys are needed to secure heavy battery packs and protect them during a collision.

Corrosion Resistance: Zinc-coated and stainless steel fasteners protect sensitive electronic components and charging systems from moisture and environmental factors.

Customization: Unique EV designs require tailored fasteners for mounting electric motors, securing interior components, and integrating advanced electronics.

Case Study: Mexico's Automotive Boom

Mexico provides a powerful example of how government strategy can create a world-class automotive hub. The country has become a top vehicle producer and exporter, attracting billions in investment from global automakers. This success is built on a foundation of supportive policies and strategic trade agreements.

Did You Know? Mexico's extensive network of trade agreements gives manufacturers tariff-free access to over 50 countries, making it a highly attractive location for automotive production.

Several key factors drive Mexico's automotive growth:

Trade Agreements: The United States-Mexico-Canada Agreement (USMCA) offers favorable market access and clear rules of origin for manufacturers.

Government Initiatives: Programs like the Automotive Industry Promotion Program (PIA) actively work to attract investment and foster innovation.

Special Economic Zones (SEZs): These zones offer tax benefits and streamlined regulations, reducing costs for companies setting up operations.

Financial Incentives: The government provides a business-friendly environment with tax incentives and subsidies to support the sector's expansion.

This combination of factors has solidified Mexico's position as a critical player in the North American and global automotive supply chain, driving immense demand for fasteners within the Emerging Markets.

Industrialization: Building the Factories of the Future

Industrial growth in new regions is building the factories of tomorrow. This expansion creates a massive need for specialized fasteners. These components are the building blocks for heavy machinery, energy infrastructure, and advanced manufacturing sectors.

Fastener Needs for Heavy Machinery and Equipment

Rapid industrialization powers the construction, mining, and agriculture sectors. These industries rely on heavy equipment like excavators and cranes. Manufacturing this machinery requires high-strength fasteners engineered for extreme loads and vibration.

Key fasteners ensure the safety and durability of heavy equipment. High-strength bolts, for example, resist powerful impacts. Other essential types include:

Heavy Hex Nuts: These are thicker and stronger for high-torque structural jobs.

Anchor Bolts: They secure heavy machinery to concrete foundations.

Lock Nuts: A special design prevents them from loosening under constant vibration.

Energy Sector Expansion in Developing Nations

Developing nations are leading global investment in renewable energy. These countries have abundant resources like solar and wind. Since 2015, investment in renewables has been higher in developing countries than in developed ones. This shift creates demand for fasteners that can perform in harsh outdoor environments. Wind turbines and solar farms need components with high tensile strength and excellent corrosion resistance. Fasteners must meet strict industry standards, such as ISO 898-1, to guarantee safety and a long service life with minimal maintenance.

Aerospace and Defense Growth in New Markets

New aerospace and defense industries are growing in Emerging Markets. This sector has some of the strictest requirements for fasteners. Components must perform perfectly under extreme temperatures and stress.

Manufacturers use special materials to meet these demands. Nickel-based alloys offer superior resistance to corrosion and heat. Companies supplying parts to this industry must earn an AS9100 certification. This certification proves a company follows the highest quality and safety standards. Buyers can verify a supplier's status through the official Online Aerospace Supplier Information System (OASIS) database.

Innovation: How Market Needs Drive New Technology

The intense demands of new global projects are accelerating fastener innovation. Manufacturers are developing advanced materials, smart technologies, and sustainable solutions to meet the challenges of modern industry. This focus on technology is reshaping what a simple fastener can do.

Advanced Materials and High-Performance Coatings

The push for efficiency and durability drives the creation of new materials. Industries like aerospace require fasteners that reduce weight without sacrificing strength. This has led to the growing use of advanced materials.

Titanium Alloys: Offer an outstanding strength-to-weight ratio and corrosion resistance, making them essential for aircraft.

Advanced Aluminum: Provides a lightweight alternative for applications where weight reduction is critical.

Fiber-Reinforced Composites: Help manufacturers meet strict environmental regulations by lowering overall product weight.

Coatings also play a vital role in fastener performance. They protect against corrosion and control friction during assembly.

Coating Type | Key Benefit |

|---|---|

Zinc-Nickel | |

Zinc Flake | Provides excellent protection with a thin layer and no hydrogen embrittlement risk. |

Hot Dipped Galvanized | Creates a thick, durable coating that hardens the base steel. |

The Rise of Smart Fasteners for Predictive Maintenance

Fasteners are becoming intelligent. "Smart fasteners" contain tiny, embedded sensors that monitor conditions like tension, temperature, and vibration in real time. These sensors wirelessly send data to a central system. Maintenance teams can then access this information on a computer or smartphone.

This technology allows companies to predict when a part might fail. Instead of performing routine manual checks, teams receive alerts about potential problems. Early adopters in the aerospace and defense industries proved the value of this technology. Now, the automotive, construction, and energy sectors are also using smart fasteners to reduce downtime and improve safety.

Sustainability and Eco-Friendly Fastening Solutions

Environmental responsibility is a growing priority in manufacturing. The fastener industry is responding with new, eco-friendly products. These solutions reduce waste and lower the carbon footprint of a project. Key developments include:

Recycled Metals: Fasteners made from recycled steel and aluminum reduce energy consumption and the need for new raw materials.

Biodegradable Polymers: Plant-based plastics offer a sustainable option for non-structural applications.

Low-Carbon Alloys: New metal alloys are being engineered to deliver high performance with a smaller environmental impact.

Companies are already bringing these innovations to market. For example, some manufacturers now offer hook-and-loop fasteners made with polyester from recycled plastic bottles, reducing CO2 emissions by nearly 30%.

Strategic Outlook: Capitalizing on Growth in 2025

Fastener companies must adopt forward-thinking strategies to succeed in the evolving global landscape. Success in 2025 depends on building resilient supply chains, embracing digital tools, and identifying the next wave of high-growth regions.

Localizing Supply Chains for Competitive Advantage

Companies are moving production closer to their customers. This strategy, known as localization, helps businesses gain a significant competitive edge. Establishing local facilities reduces dependency on international shipping and creates a more stable supply network. The benefits are clear and immediate.

It lowers shipping costs and eliminates long wait times.

It allows for faster project completion with dependable delivery.

It reduces the need for large, expensive stockpiles of inventory.

It provides access to expert help for selecting the right parts.

It decreases pollution from long-distance shipping.

Digitalization and E-Commerce in B2B Procurement

Digital technology is transforming how fasteners are designed and purchased. Companies now use digital twins, which are virtual models of a product or process. This technology allows engineers to simulate how a fastener will perform. They can test for cost, durability, and manufacturability before ever making a physical part.

This digital approach connects every step of the process. If an engineer needs to make a screw slightly longer, the digital system automatically updates the design, manufacturing instructions, and supply chain orders. This integration prevents miscommunication and costly errors, making the entire procurement process faster and more efficient.

Future Hotspots: Vietnam, Indonesia, and Beyond

While established markets remain important, the next major growth opportunities are in Southeast Asia. Vietnam and Indonesia are becoming powerful centers for manufacturing and construction. Both nations are attracting billions in foreign direct investment for new factories and infrastructure projects.

Vietnam's economy is driven by exports and a growing high-tech manufacturing sector, including a rising aerospace industry. Indonesia offers a huge domestic market and is investing heavily in its energy and mining sectors. These dynamic Emerging Markets represent the future of fastener demand, creating significant opportunities for suppliers ready to meet their needs.

The fastener industry's future is directly linked to the dynamic growth of Emerging Markets. Demand for advanced, reliable, and sustainable fastening solutions is the central force shaping the global landscape.

Businesses that strategically align with these regional needs will lead the industry. Companies that localize supply chains, embrace digitalization, and pursue innovation are positioned for success in 2025 and beyond.

FAQ

Which regions are driving fastener demand?

Emerging markets in Asia, the Middle East, and Africa are the main drivers. Massive infrastructure projects and growing automotive sectors in these regions create powerful demand for a wide range of fastening solutions.

What types of fasteners are needed for construction?

Construction projects require many fastener types.

Structural bolts and anchors are vital for steel frames.

Wood construction uses large volumes of industrial nails and staples.

Hog rings are also used for applications like securing fencing.

How do electric vehicles (EVs) affect the fastener industry?

EVs need more fasteners than traditional cars, especially for heavy battery packs. This shift increases demand for specialized, high-strength, and lightweight components. These parts ensure vehicle safety and improve battery range.

Why is localizing supply chains important for fastener companies?

Localizing production brings companies closer to their customers. This strategy reduces shipping costs and delays. It also creates a more reliable supply network, giving businesses a strong competitive advantage in fast-growing markets.